Pennsylvania Jump$tart Coalition for Personal Financial Literacy

An Independent Affiliate of the Jump$tart Coalition

If you’re involved with or concerned about Pennsylvania’s young people learning how to handle money successfully – you’ve come to the right place! The Pennsylvania Jump$tart Coalition for Personal Financial Literacy is a statewide, all-volunteer, non-profit organization dedicated to improving the financial literacy of Pennsylvania’s youth since 1999. Consisting of over thirty-five individuals and organizations, the coalition brings together businesses, government agencies, and educators.

A Proud State Affiliate

The Pennsylvania Jump$tart Coalition is an independent affiliate of the national Jump$tart Coalition for Personal Financial Literacy. The national Jump$tart Coalition is a 501(c)(3) tax-exempt non-profit organization headquartered in Washington, D.C. Founded in 1995, the coalition includes more than 100 national partners and a network of 51 state affiliates that share a commitment to #afinlitfuture and to working collaboratively toward common goals.

What We Do

The Pennsylvania Jump$tart Coalition has the following goals:

- Increase financial literacy among the youth of Pennsylvania

- Enhance professional development in financial literacy

- Raise public awareness of the need for financial literacy

- Assist other charitable and educational organizations in the conduct of financial literacy efforts

We are working to achieve these by:

- Drawing attention to the need for financial education during April’s annual Financial Capability Month

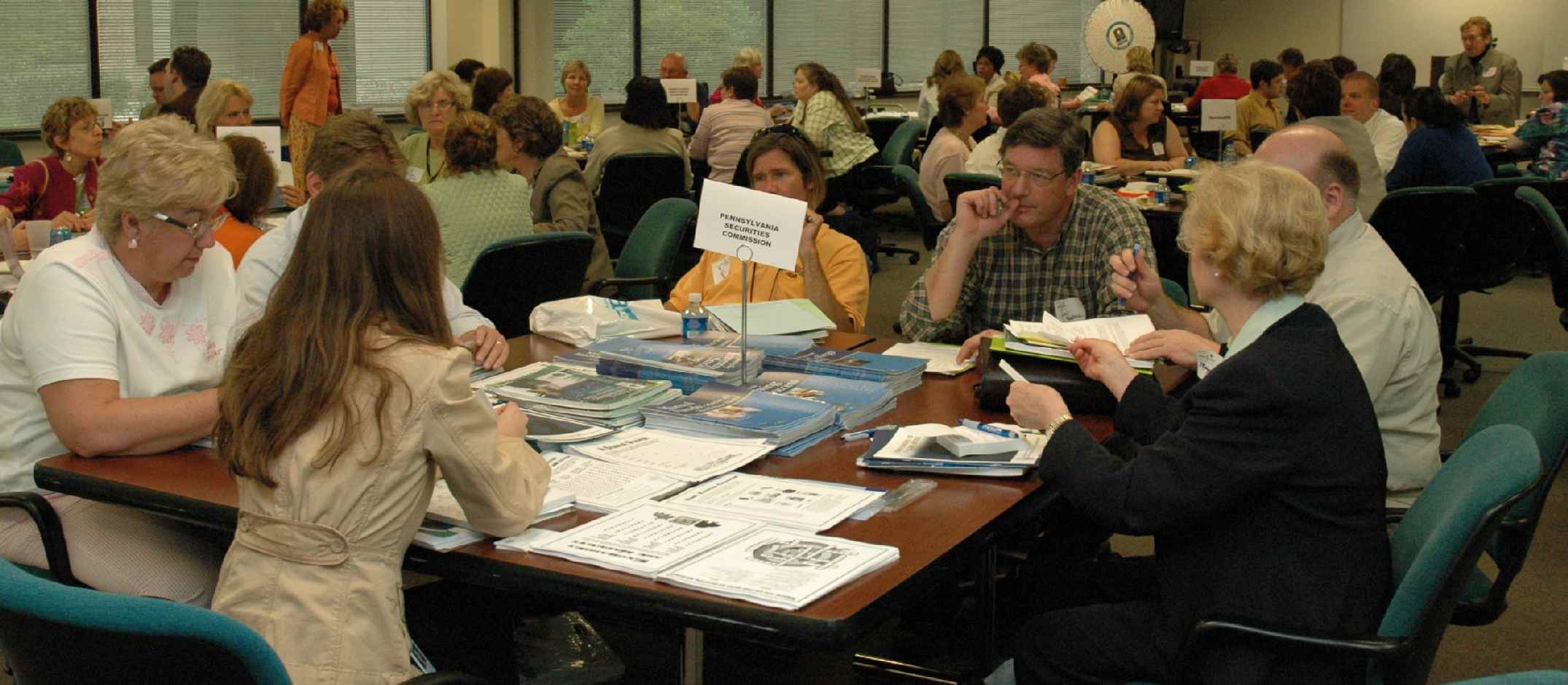

- Hosting meetings

- Sharing information through our coalition’s e-newsletter

- Partnering on projects and special events

- Conducting our own professional development programs and supporting the efforts of coalition partners

Get Involved

There are many ways organizations or individuals can become involved with the Coalition.

Attend a Meeting or Coalition Event

Check out our schedule of upcoming meetings and make plans to attend. Does your organization have space and/or technology to host a meeting? If so, let us know.

Join the Coalition

If you and/or your organization are actively engaged in promoting personal financial literacy amongst youth, we invite you to become a partner.

Support the Coalition!

The Pennsylvania Jump$tart Coalition is a charitable 501(c)3, nonprofit organization. As such, in-kind donations, such as the printing of promotional materials or hosting of meetings and events, are greatly appreciated. The Coalition also welcomes monetary contributions. Send us a message, and we can discuss options for providing in-kind or monetary contributions.

Make a Difference Locally

Both organizations and individuals can make a great impact at the local level. Here are just a few ways you can make a difference:

- Financial Institutions: Volunteer to work with a local school or district to provide classroom presentations or teacher support.

- Educators: Incorporate personal finance within your curriculum. Personal finance has been taught successfully to students of all ages and within many core and elective subjects. For more resources, go to Clearinghouse and search according to your grade and subject matter.

- Policy Makers: Consider ways to incorporate personal finance education into your school’s curriculum and teacher professional development programs. Remember, you need not reinvent the wheel. The Pennsylvania Jump$tart Coalition can help you identify successful models.

- Parents: Begin teaching your child about personal finance at a young age and continue to reinforce these skills. Need help? Contact a partner organization or check out the materials in the National Jump$tart Coalition’s Clearinghouse.

Connect With Us

Follow the Pennsylvania Jump$tart Coalition on one or more of the following social media channels.

LinkedIn: https://www.linkedin.com/company/pennsylvania-jump-start-coalition/

Twitter: https://twitter.com/PAJumpStart

Facebook: https://www.facebook.com/PAJumpstart

Instagram: https://instagram.com/pajumpstart

Financial Education in Pennsylvania

So, what is the status of financial education in Pennsylvania? Glad you asked!

The short answer is, “It depends on where you live.” The long answer is just that — long. The Pennsylvania Jump$tart Coalition is pleased to offer basic information along with links to more in-depth sources of information.

We’ve compiled answers to some of the most frequently asked questions. You can also check out legislation and policies that relate to financial education here in Pennsylvania.

Q

Does Pennsylvania require all students to take a course in personal finance before they graduate?

A

Not yet. At present, whether or not a student is required to take a course depends on the graduation requirements set forth by the local school district. These requirements can vary greatly from one school district to another. Some school districts have required a course in personal finance for graduation for many years. Other school districts recently changed their personal finance requirements. Changes can be driven by teachers, administrators, parents, students, board members, or community members.

Begining with the 2026-2027 all schools will be required to provide a mandatory course in personal financial literacy of 0.5 credit or greater. Students will be required to complete the course in grades nine through twelve in order to graduate. This requirement is part of Act 35 of 2023. Additional clarification and interpretation is expected in the coming months.

Q

How do I find out if personal finance is offered and/or required in my local school district?

A

There are several places where you can access information on the status of personal finance in your local school district. The data may be different as each organization uses different methodology and collects information at separate times.

- Pennsylvania’s Making Cents Project — a cooperative effort of the Pennsylvania Department of Education and Penn State University

- Next Gen Personal Finance

- Check Your School

Q

Who can teach personal finance in Pennsylvania?

A

Personal finance can be taught by educators with any of the following at the certifications:

- CSPG 33 – Business, Computer and Information Technology

- CSPG 35 – Citizenship Education

- CSPG 44 – Family & Consumer Sciences

- CSPG 49 – Marketing/Distributive Education

- CSPG 50 – Mathematics

- CSPG 52 – Middle Level Social Studies

- CSPG 53 – Middle Level Mathematics

- CSPG 59 – Social Studies

- CSPG 69 – Grades PK-4

- CSPG 70 – Grades 4-8

Q

What organizations are involved in financial education in Pennsylvania?

A

Check out our list of partner organizations to see some of the organizations involved in financial education in Pennsylvania.